We are an independent energy infrastructure company that develops, operates and invests in critical midstream infrastructure. Our business strategy is built on three core themes:

Continue to support and maintain the UK’s energy security

Focus on securing a sustainable net zero energy transition

Work with our industry partners to create sustainable value

Our strategic priorities include securing the long-term viability of our assets, delivering sustained asset evolution, and unlocking future investment to create sustainable value for our shareholders. By doing this, we aim to:

Deliver long-term benefits for our employees, customers, communities, shareholders and society.

Develop strong partnerships with industry and government to maximise the potential of existing and new energies.

Enable a net zero future by developing, operating and investing in the most critical infrastructure.

Establish new capability by building the capacity for low carbon hydrogen and other new energies

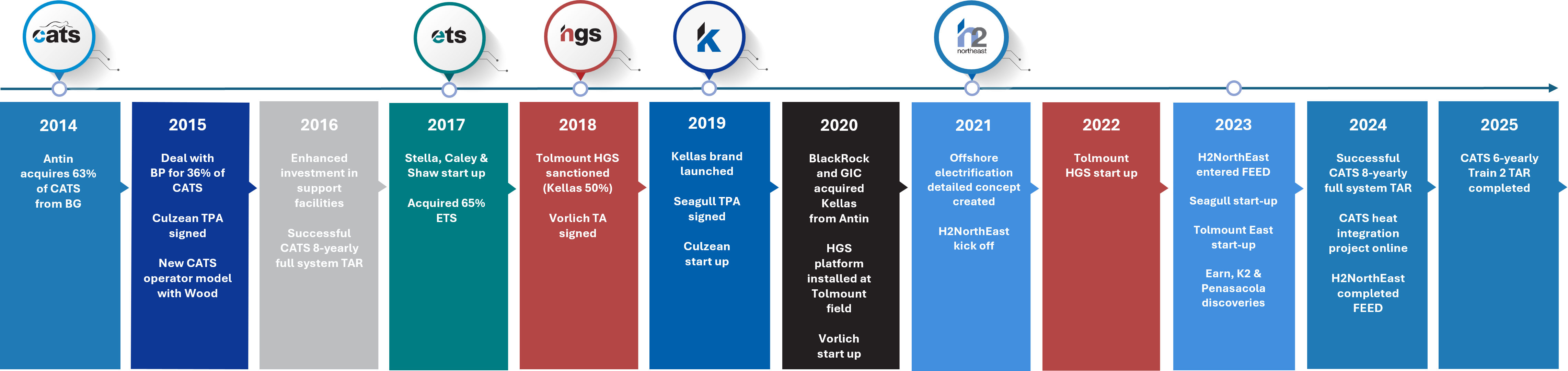

Our story began in 2014 when Antin Infrastructure Partners invested in the Central Area Transmission System (CATS) via CATS Management Limited, the entity formed to manage Antin's interests in the North Sea. CATS Management set the strategy, delivering safe and efficient operational and financial performance, and growing the business.

Following further investment in the Central and Southern North Sea, and to reflect its growing portfolio, CATS Management rebranded its business to Kellas Midstream.

In only a few years, we have grown significantly – adding the Esmond Transportation System (ETS), and the Humber Gathering System (HGS) to our portfolio; and welcoming new people to our team, whose expertise has added great value to our organisation.

After such success, in early 2020, Antin Infrastructure Partners sold their interest in Kellas Midstream to global investment and asset managers BlackRock and GIC.

Our nationally-significant role in UK energy was recognised by industry when we won the Outstanding Contribution to Energy Security award at the 2023 Offshore Energies UK (OEUK) Awards.

Kellas Midstream is owned by a consortium of two private equity fund managers, BlackRock and GIC.

Private equity infrastructure investors, such as BlackRock and GIC, have access to different sources of capital, the midstream assets they acquire are core to their portfolio, and they are committed to investing in them to build safe, successful and sustainable businesses.

6th Floor, The Capitol

431 Union St

Aberdeen

AB11 6DA

Tel: +44 (0) 1224 084520

To report a pipeline emergency please call +44 (0)1642 546404 and ask for the Operations team.